Harness Positive Momentum

Merrill Lynch RPM IndexTM

Modern Index Construction Seeking Broad Diversification

The RPM Index is designed to leverage principles used by the largest financial institutions – including diversification, positive momentum and risk control – to help generate consistent returns in good and bad market environments. Diversification starts with a group of global asset classes across equities, fixed income and real assets:1

- Domestic Equities

- International Equities

- Emerging Markets Equities

- Gold

- Real Estate

- Bonds

The RPM Index applies a rules-based approach to eliminate emotion, bias and the need to time the markets. The asset classes are rebalanced each month to reduce risk and correlation while leveraging positive short-term momentum. The result is an index that seeks to provide a broader level of diversification.

Key Terms and Resources

CORRELATION – The price relationship between two asset classes. Asset classes with high correlation tend to move in the same direction. Asset classes with low correlation tend to move independently.

MOMENTUM – The tendency for assets with demonstrated short-term performance, positive or negative, to continue to perform. The RPM Index removes asset classes that have negative 12-month momentum.

RISK – Rapid price changes up or down increase the risk of short-term losses. Each month, the RPM Index is designed to allocate more to asset classes exhibiting lower risk and less to asset classes exhibiting higher risk. Daily risk control is applied, which seeks to further reduce risk.

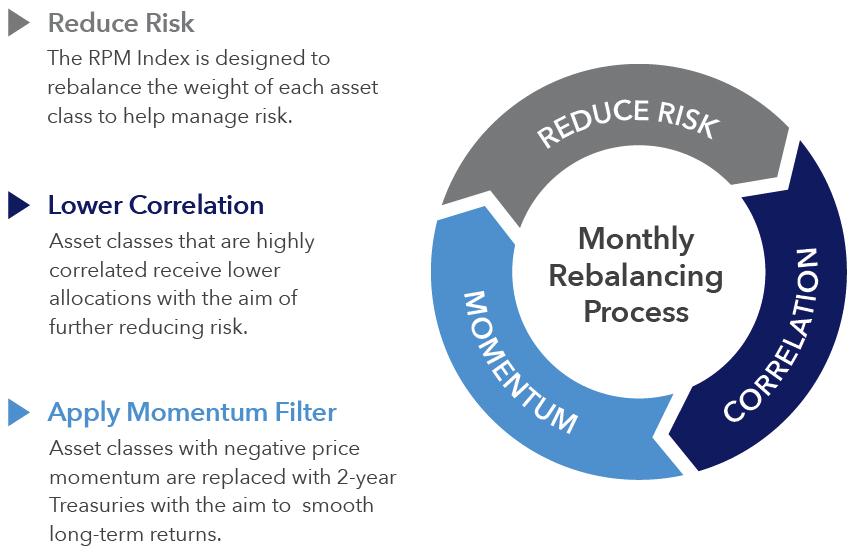

A Monthly Rebalancing Process Leveraging Positive Momentum

The RPM Index evaluates and rebalances the six asset classes based on risk, correlation and momentum over the previous 12 months. The monthly rebalancing process is designed to help the RPM Index capitalize on short-term changes in the asset classes and provide the potential for more consistent performance.

The RPM Index also applies daily risk control designed to help further minimize the impact of rapid up or down movements in the asset classes. Allocations can be made daily between the monthly allocation described above and a cash account to further reduce risk.

Broad Diversification

Designed to Provide Consistent Returns Throughout Market Cycles

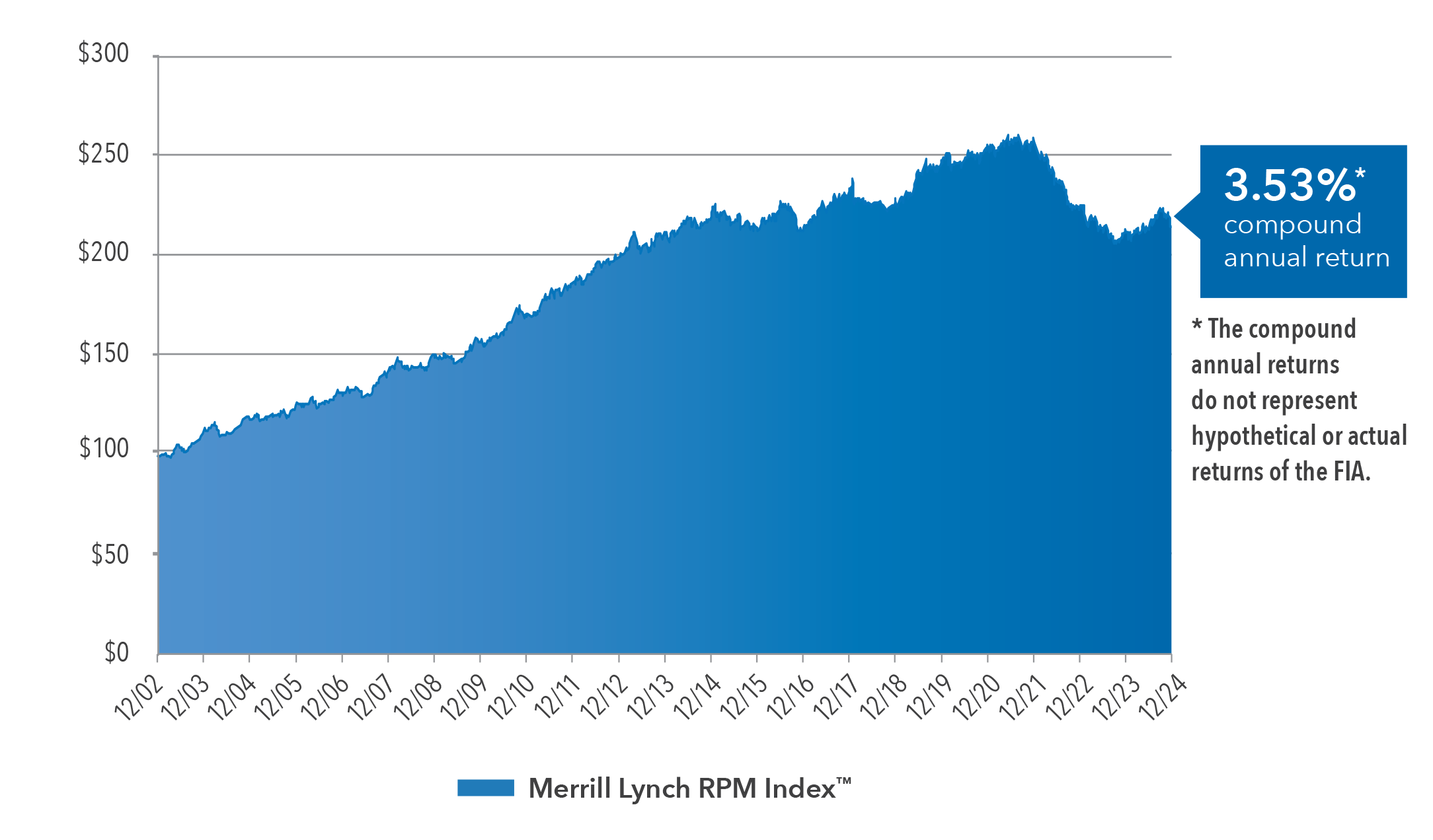

Over the last 22 years, the RPM Index would have harnessed positive momentum to produce a 3.53% compound annual return and provide the opportunity for steady growth in a variety of market conditions, as demonstrated by the relatively consistent movement of the blue line below.

Merrill Lynch RPM Index™ Performance

**Hypothetical Assumptions: $100 invested in the Merrill Lynch RPM Index™ from 12/31/02 to 12/31/24. The RPM Index was established on 3/1/16. Performance shown before this date for the Merrill Lynch RPM Index™ is back-tested by applying the index strategy, which was designed with the benefit of hindsight, to historical financial data. Back-tested performance is hypothetical and has been provided for informational purposes only. Past performance is not indicative of nor does it guarantee future performance. The foregoing performance information does not include any relevant costs, participation rates, or charges associated with the Athene Velocity or any other financial product linked to the Merrill Lynch RPM Index. For more information on the Athene Velocity and performance with the RPM Index, ask your insurance professional for an illustration.

The Merrill Lynch RPM Index is available with Athene Velocity. Rates and product availability will vary by state and results may be higher or lower. See your insurance professional for detailed information.